Afriex: Building Bridges Through Fair Finance

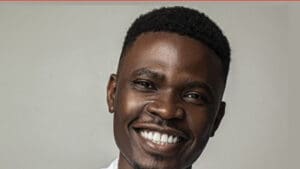

Founded in 2019 by Nigerian entrepreneurs Tope Alabi and John Obirije, Afriex began with a simple mission — to make global money movement fast, fair, and accessible.

The idea was born from personal experience. As immigrants in the United States, Alabi and Obirije faced high fees and unreliable systems when sending money home. They saw how much value was lost before funds even reached family members. That frustration inspired them to build something better.

From its early days serving the U.S.–Nigeria corridor, Afriex has grown into a global platform helping people send, receive, and exchange money instantly across borders. The company integrates global payment networks and local partnerships to make cross-border transfers faster, cheaper, and more accessible to underserved communities.

Afriex has expanded to Ghana, Kenya, and beyond, now serving hundreds of thousands of users worldwide. The company has also raised significant venture funding to scale its infrastructure and introduce tools for businesses, such as cross-border FX and treasury management solutions.

Afriex is built on values of trust, transparency, and inclusion. Its founders believe every transfer represents more than money — it represents hope, opportunity, and community. As Tope Alabi explains, “Every dollar sent home tells a story. It might pay a child’s school fees or help a small business grow. That’s why we build with empathy first.”

Today, Afriex stands as a leader in financial innovation, empowering the global diaspora to stay connected and thrive through fair financial access.

Q&A with Afriex

What inspired you to start Afriex?

The idea came from personal experience. When I moved to the United States, sending money home to Nigeria was frustrating. Transfers took days, the fees were high, and the exchange rates were poor. I realised this wasn’t just my problem — millions of immigrants faced the same thing. So, in 2019, my co-founder John and I decided to build Afriex to make cross-border payments faster, cheaper, and fairer.

How did you go from that initial idea to launching the company?

We started small. Our first focus was the U.S.–Nigeria corridor because that’s where we knew the problem best. We wanted to prove that instant, affordable transfers were possible. In 2019, we launched the first version of our app. By 2020, we’d expanded into Ghana and Kenya, offering zero-fee transfers. Those early users believed in us — and that gave us momentum.

What does the name “Afriex” mean?

It’s a blend of “Africa” and “exchange.” The name captures our goal — to connect Africa with the world through seamless financial exchange. It’s about more than money; it’s about inclusion, opportunity, and connection.

What do you think has helped Afriex stand out in a crowded fintech space?

We focus on real problems. Our users trust us because we’ve lived the same experiences. We combine traditional financial systems with blockchain-backed stablecoins to make transactions instant and affordable. It’s a hybrid model that balances innovation and stability.

What have been some key milestones for Afriex so far?

A big moment came in 2021 when we raised $10 million in venture funding. That allowed us to grow faster and serve more countries. By 2022, we’d reached hundreds of thousands of users and began building tools for businesses — things like global FX solutions and treasury management. Between 2023 and 2025, we’ve scaled across multiple corridors, launched referral programmes, and started developing travel cards and business payment products.

How would you describe Afriex’s mission today?

Our mission is to build the world’s most trusted financial platform for the global diaspora. We want to empower people to send money, trade, and access opportunity anywhere in the world. Financial inclusion is at the heart of what we do.

You’ve spoken about trust and empathy being key values. How does that influence the way you lead?

Trust is everything. People trust us with their hard-earned money, so we have to earn that every single day. I also believe in empathy-driven leadership. When you understand your customers’ struggles because you’ve lived them, you design better solutions. It’s the same for our team — we listen, learn, and grow together.

How do you see technology shaping the future of cross-border payments?

Technology is the bridge. It allows us to remove barriers that have existed for decades. Whether it’s blockchain or mobile-first design, the goal is to make finance simpler and more accessible. But I also think it’s about balance — using innovation responsibly and keeping the user’s needs front and centre.

What challenges have you faced while growing Afriex?

There have been plenty. Regulation is complex, and every market is different. Building trust across borders takes time. But challenges push us to be creative. We’re constantly learning how to operate better, faster, and more transparently.

What keeps you motivated?

Hearing from our users. When someone tells us that Afriex helped them pay their child’s school fees or support a family business, that’s what keeps me going. Every transfer has a story behind it. We’re not just moving money — we’re moving hope.

What’s next for Afriex?

We’re focused on expanding globally and creating products that help both individuals and businesses. Beyond remittances, we want to make international finance fair and frictionless for everyone.

Any advice for young entrepreneurs in fintech?

Start with a problem you truly understand. Stay humble, stay curious, and listen to your users. Innovation doesn’t start with technology — it starts with empathy.

Read more:

Afriex: Building Bridges Through Fair Finance