Shifting Gears: How Mercedes-Benz Is Steering Its Global Transformation (2024–2025)

In 2024 Mercedes-Benz Group generated €145.6 billion in revenue and €13.6 billion in EBIT from 2.39 million vehicle sales. Profitability narrowed as price wars in the electric-vehicle (EV) segment and a softer Chinese market bit into margins.

As AUTODOC neatly put it, ‘Mercedes-Benz Group navigated a demanding global landscape shaped by tightening margins, intensified EV competition, and regionally uneven consumer demand.’ Below are the key transformation moves which should restore momentum in 2025.

1. Portfolio reset

The company is shrinking its architectures from eight to three (MMA, MB.EA, AMG-EA) and will cut traditional engine variants by 40 per cent by 2027. Standardised battery modules and a unified software stack will lower costs and slash time-to-market. Flagship luxury lines (S-, E-, and G-Class) remain margin leaders, while the entry tier focuses on more affordable electric hatchbacks and crossovers.

2. Supply chain and ‘gigacasting’

A new gigacasting shop in Sindelfingen is trimming body-in-white costs by up to 15 per cent, while EU-based battery localisation (ACC, CATL Hungary) shields the group from currency swings. By 2030, Mercedes aims for 50 per cent ‘green’ steel; Stuttgart plants already run on 100 per cent renewables.

3. After-sales & parts boom

Even with softer new-car demand, the aftermarket grew 7 per cent year-on-year. The Mercedes-Benz Parts Store reports brisk sales of body panels for compact models; the MERCEDES-BENZ A-Class bumper ranks in the European top five. Robust parts income is cushioning thinner EV margins.

4. Regional snapshot – Britain’s pivotal test-bed

Why Britain matters to Mercedes-Benz

- Brand momentum: Mercedes-Benz logged 102,757 new-car registrations in 2024, a 17 % jump that lifted its share to 5.3 % – the brand’s best UK performance since 2020.

- Electric traction: The EQA cracked the national top-10 BEV chart with 11,617 units, ahead of the VW ID.4 and Polestar 2. Mercedes BEV registrations in the private retail channel grew by +26 %, signalling solid premium-EV appetite.

- Mandate pressure: 2024 ushered in the Zero-Emission Vehicle mandate (22 % of cars / 10 % of vans must be zero-emission, rising to 28 % / 13 % in 2025). Thanks to credit flexibilities the overall 19.6 % BEV mix still met compliance in year one.

- Charging showcase: To bolster sales credits and the agency model, Mercedes is rolling out its first UK High-Power Charging Hub in Milton Keynes (six 300 kW bays, live late-2025) alongside 2,500 pan-European chargers planned by 2027

5. Electrification – 2024 hiccup, MMA to the rescue

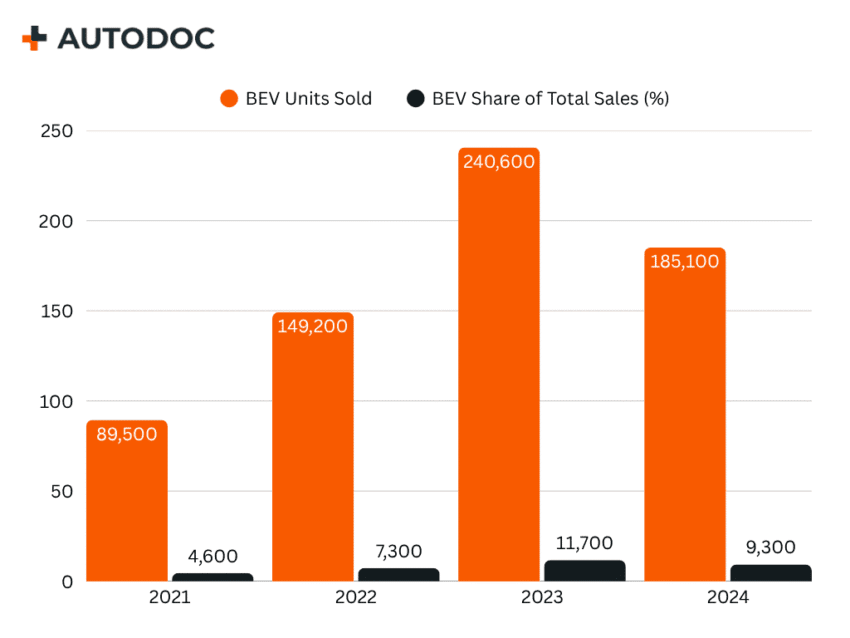

As noted by AUTODOC: In 2024, Mercedes-Benz Cars sold 185,059 battery electric vehicles (BEVs) globally, down from 240,668 in 2023. This marks a −23.1% year-on-year decline. The share of BEVs in total Mercedes-Benz Cars sales fell from 11.8% in 2023 to 9.3% in 2024.

This decline occurred amid increased pricing pressure, competitive EV offerings from new market entrants, and evolving consumer confidence in charging infrastructure availability.

6. Looking ahead to 2025

- Risks: possible EU–China tariffs of up to 30 per cent could inflate battery costs; a SiC chip shortage may delay MB.EA roll-outs.

- Opportunities: licensing MB.OS to other premium brands and a €3,000-per-year Level 3 Autopilot subscription promise rich post-sale revenue.

- Targets: xEV share ≥ 25 per cent and ROCE > 10 per cent. If gigacasting and software monetisation land on time, Mercedes aims to regain a 12 per cent luxury margin by Q4 2025.

Takeaways

Mercedes-Benz is moving from ‘volume = success’ to a ‘digital-premium + loyal aftermarket’ model. The hinge question is whether the new electric platforms can launch before Chinese and US rivals cement themselves at the top end. For now, growing parts sales and rapid charger expansion are offsetting 2024’s electrification lull. The coming year will be decisive: can the brand turn engineering heritage into a profitable digital ecosystem?

Additional information:

Mercedes-Benz automotive group – overview of global indicators from AUTODOC

Mercedes-Benz lays out its roadmap for profitable growth

Read more:

Shifting Gears: How Mercedes-Benz Is Steering Its Global Transformation (2024–2025)